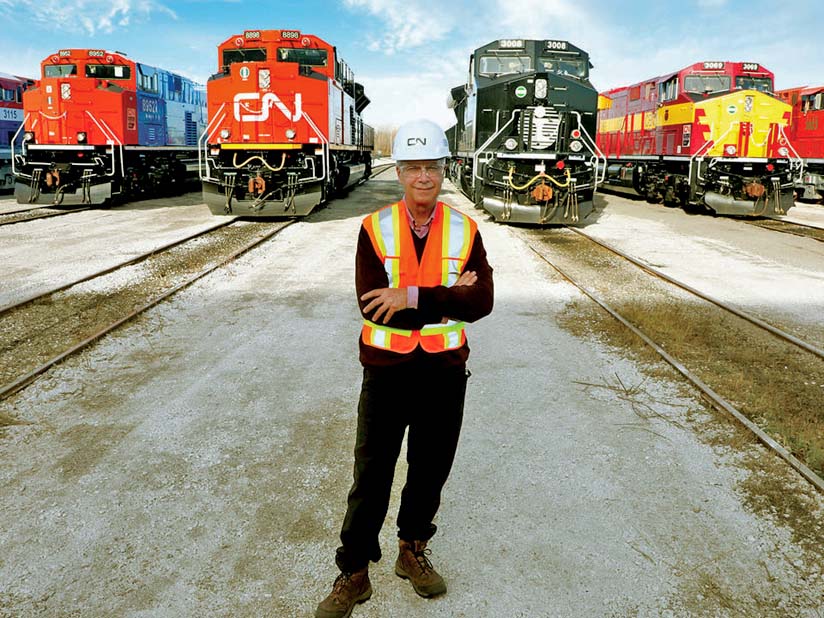

Montreal Quebec - CN has no plans to back off from its proposed acquisition of KCS and remains confident that it can obtain the necessary

regulatory approvals to create the first railroad linking Canada, the U.S., and Mexico, CEO JJ Ruest said today.

Ruest's comments came a day after CN's fifth largest shareholder, TCI Fund Management, urged the company to abandon its pursuit of KCS, citing regulatory risk

surrounding the US$33.6 billion deal.

"Leave no doubt, CN is very committed to this transaction. We are connected to all our shareholders, customers, and stakeholders. We believe the public

benefit is quite significant. We believe the long-term value creation for our shareholders also is very large. We believe the regulatory risk is being managed

properly, step by step," Ruest says.

Ruest says that while some may view CN's move as bold, being bold is what's required to create the first premier north-south railroad that links North

America.

CN has had ongoing discussions with its shareholders about the proposed KCS acquisition, takes their views into account, and welcomes their feedback, Ruest

says.

"Most of them actually are very excited about the combination, and what it could do to make the company much more valuable in the long term. Two of them

actually came out publicly in support for the merger, which is not necessarily common. Cascade and CDPQ have made their views known to us and also publicly.

Obviously TCI, has a different view," Ruest says.

Cascade Investments is the investment vehicle of former Microsoft Chairman Bill Gates, who has since passed his stake in CN along to his wife Melinda as part

of their divorce settlement.

CDPQ is the Quebec pension fund, Caisse de depot et placement du Quebec.

TCI in a letter to CN Chairman Robert Pace, said that it's simply too big of a gamble for CN to pursue KCS in light of regulatory uncertainty surrounding two

regulatory hurdles.

The first is whether KCS can be placed into a voting trust while the merger is under review.

The second is winning approval for the combination.

The Surface Transportation Board will review the CN/KCS deal under more stringent and untested merger rules that date to 2001.

Regulators on Monday said they would take a more cautious approach to a KCS voting trust involving a CN/KCS merger, and raised concerns about the level of debt

CN would use to fund the acquisition.

TCI is the largest single investor in Canadian Pacific, whose proposed acquisition of KCS faces an easier regulatory path under the board's old merger

rules.

The STB also approved the use of a voting trust for the CP/KCS combination.

Ruest says CN will show regulators it has the financial strength to acquire KCS, and that the merger will be pro-competitive and in the public

interest.

The deal requires the approval of KCS shareholders, but not CN's.

Ruest spoke at a Bank of America investor conference today.

Bill Stephens.

(because there was no image with original article)

(usually because it's been seen before)

provisions in Section 29 of the Canadian

Copyright Modernization Act.