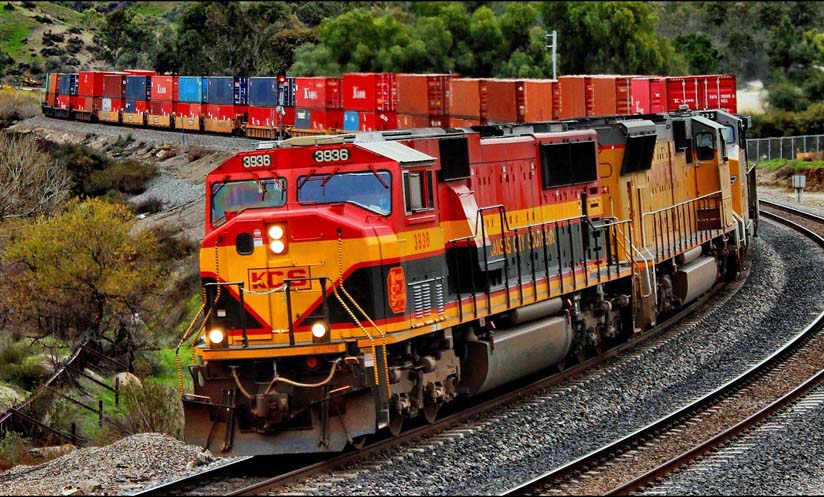

Calgary Alberta - Canadian Pacific Railway Limited (CP) and Kansas City Southern (KCS) today announced they have jointly filed a railroad

control application with the Surface Transportation Board (STB) regarding the proposed transaction to create Canadian Pacific Kansas City (CPKC), the only

single-line railroad linking the United States, Mexico, and Canada.

"We are excited to file our joint application for this unique, pro-competitive, combination and once-in-a-lifetime partnership. CPKC is an extraordinary

opportunity to inject new competition and new capacity into the U.S. rail network, further USMCA trade flows, improve safety, grow employment, and facilitate

new passenger services. We are ready to work with the STB as the board gives this transaction a thorough and appropriate review, and ultimately look forward to

approval so we can get to work delivering these benefits to the North American economy," said Keith Creel, CP President and Chief Executive

Officer.

"We are pleased to submit this application together and take another important step toward bringing to fruition this historic opportunity for CP and

KCS. In fierce competition with other railroads, trucks, and other modes of transportation, CPKC will provide new routes, reach broader markets, and create

expanded shipping opportunities for customers. This combination will also unlock new infrastructure investment and environmentally-friendly supply chain

transportation options that will grow the USMCA economy," said Patrick J. Ottensmeyer, KCS President and Chief Executive Officer.

The comprehensive control application provides an overview of the proposed operational integration of the CP and KCS rail networks, the impact of that

consolidation on the companies' finances and labour needs, and the anticipated competitive and other benefits that will flow from providing shippers with new

and better transportation alternatives.

Information in the filing outlines the public and customer benefits a CP/KCS combination would bring, including more efficient north-south trade arteries to

support the interconnected supply chains of the United States, Mexico, and Canada.

In addition to the central foundation of the transaction to invigorate transportation competition and support economic growth across North America, the CP/KCS

combination will generate many other public benefits, including:

- The creation of more than 1,000 direct new jobs system-wide, including approximately 760 in the United States, over the next three years brought about by

expanded rail operations across the combined network;

- Capital investments in new infrastructure of more than US$275 million over the next three years to improve rail safety and capacity of the core

north-south CPKC main line between Louisiana and the Upper Midwest;

- Avoidance of more than 1.5 million tons of greenhouse gas (GHG) emissions within five years due to the improved efficiency of CPKC versus current

operations;

- Diverting 64,000 long-haul truck shipments to rail annually with new CPKC intermodal services, eliminating another 1.3 million tons of GHG emissions over the next two decades, saving US$750 million in highway maintenance costs.

Rail customers will not experience a reduction in independent railroad choices as a result of the CP/KCS combination.

The joint control application reiterates the applicants' commitment to keep all existing freight rail gateways open on commercially reasonable terms, including

the Laredo gateway between the United States and Mexico, and shows how customers will not lose competitive routings because no new regulatory

"bottlenecks" are being created.

It also describes how the combined company will compete aggressively to attract traffic to its network via new single-line lanes between Canada, the Upper

Midwest, and the Gulf Coast, Texas, and Mexico.

More than 960 stakeholders, including more than 440 shippers, 186 smaller railroads, dozens of public officials, eight major ports, railroad labor unions

representing both CP and KCS employees, and 289 rail industry suppliers have written letters to the STB supporting CP's proposed combination with

KCS.

CP has agreed to acquire KCS in a stock and cash transaction representing an enterprise value of approximately US$31 billion, which includes the assumption of

US$3.8 billion of outstanding KCS debt.

The transaction, which has the unanimous support of both boards of directors, values KCS at US$300 per share, representing a 34 percent premium, based on the

CP closing price on 9 Aug 2021, the date prior to which CP submitted a revised offer to acquire KCS, and KCS' unaffected closing price on

19 Mar 2021.

The transaction is subject to approval by shareholders of each company along with satisfaction of customary closing conditions, including Mexican regulatory

approvals.

Shareholders are expected to vote on the transaction later this year.

CP's ultimate acquisition of control of KCS' U.S. railways is subject to the approval of the STB.

In April 2021, the STB determined it would review the CP/KCS combination under the merger rules in existence prior to 2001 and the waiver granted to KCS in

2001 to exempt it from the 2001 merger rules.

In August 2021, the STB reaffirmed that the pre-2001 rules would govern its review of the CP/KCS transaction. On 30 Sep 2021 the STB confirmed that it has

approved the use of a voting trust for the CP/KCS combination.

The STB review of CP's proposed control of KCS is expected to be completed in the second half of 2022.

Upon obtaining control approval, the two companies will be integrated fully over the ensuing three years, unlocking the benefits of the

combination.

While remaining the smallest of six U.S. Class 1 railroads by revenue, the combined company would have a much larger and more competitive network, operating

approximately 20,000 miles of rail, employing close to 20,000 people, and generating total revenues of approximately US$8.7 billion based on 2020 actual

revenues.

For more information about the benefits of the CP/KCS combination, visit futureforfreight.com .

.

Author unknown.

(there was no image with original article)

(usually because it's been seen before)

provisions in Section 29 of the Canadian

Copyright Modernization Act.