Canada - A lack of drayage capacity in Toronto and Montreal for receiving cargo from Prince

Rupert and Vancouver is increasingly putting upstream pressure on the West Coast ports, keeping rail dwells elevated at

marine terminals, and slowing the inland movement of Asian imports.

Vancouver has been grappling with persistent bouts of congestion since last summer due to a series of mishaps,

wildfires and flooding that crippled road and rail infrastructure in British Columbia, and sub-freezing temperatures

this winter that compounded the rail problems.

Cargo flow through Prince Rupert has been relatively smoother.

In addition to serving markets in eastern Canada, the ports also serve as gateways for US-bound cargo.

Cargo volumes this year highlight the fact that inland bottlenecks, not container volumes, are the cause of the ports'

woes.

Vancouver's container volume was down 13.7 percent in January through May from the year-ago period, according to the

port.

Prince Rupert data shows the port's volume was up 1 percent through the first five months of the year.

"Rail dwell is challenging across the port due to capacity constraints in the network and inland terminals, and

this is not isolated to terminals within the Port of Vancouver," GCT Canada, which operates the Deltaport and

Vanterm terminals in Vancouver, told JOC.com in a statement.

The congestion at rail hubs in eastern Canada is a direct result of drayage capacity shortages at those

facilities.

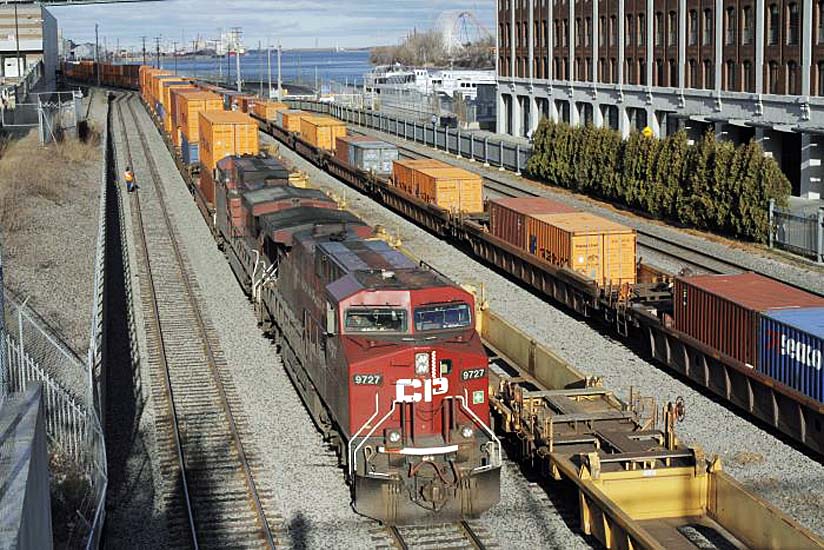

"It's an on-going situation with both railroads (Canadian Pacific and Canadian National)," said Julia

Kuzeljevich, public affairs manager at the Canadian International Freight Forwarders Association (CIFFA).

"There are fewer drivers in Toronto to handle the volume, creating a backlog/congestion issue. On a YTD basis,

total truck visits declined by 18.5 percent," CIFFA said in a bulletin to its membership.

CIFFA noted that the drayage problem, which first surfaced in Toronto in May, has extended to Montreal.

Railroad Metering Cargo

As a result of the congestion at their inland facilities, the railroads are metering, or managing how many trains they

are deploying to Vancouver and Prince Rupert.

This is causing rail containers to back up at the marine terminals because of reduced train capacity.

However, the situation at marine terminals is fluid, with rail dwells changing from day to day.

For example, at GCT Deltaport, the largest container terminal in Vancouver, containers for both railroads were dwelling

an average of seven days or longer last Tuesday, according to numbers posted on the Port of Vancouver

website.

The average dwell on Wednesday dropped to five to seven days for CP containers, and three to five days for CN

containers.

On Thursday, the CP containers were still dwelling five to seven days, but the CN dwells shot back up over seven days,

according to the port.

Dwells of longer than three days cause congestion problems.

When the container dwells begin to build for one of the railroads, hampering operations, the terminals immediately push

more containers to the other railroad because those containers can be vacated more smoothly, which helps to relieve

overall congestion at the marine terminal.

However, the second railroad's operations can quickly become overloaded.

Canada's Whiplash

Although the whiplash effect of inland rail congestion on West Coast ports has been pervasive in the US the past year,

it has not been a serious problem in Canada until recently.

"It never happened before," Maksim Mihic, CEO and general manager at DP World Canada, told

JOC.com.

DP World operates the Centerm and Fraser Surrey Docks terminals in Vancouver and Prince Rupert's Fairview

terminal.

"We're seeing elevated dwells because of delays in Toronto and Montreal," said Brian Friesen, vice president

of trade development and communications at the Port of Prince Rupert.

However, DP World two weeks ago opened a near-dock surge yard near the Fairview terminal and has already begun to move

containers there for temporary storage, so that timely move should prevent rail congestion at the port from worsening,

Friesen said.

Neither the ports nor the railroads are ready to forecast a return to normal.

"The drayage and warehouse capacity constraints in Toronto and Montreal have become so chronic that we are now in

a situation of a potential back-up for some time until this gets addressed," CN said in a statement.

CP, which said "heavy volumes" of intermodal cargo are also contributing to excessive container dwells at the

ports, adds that the main issue in the supply chain can be traced to long-dwelling containers at the inland rail

ramps.

"To maintain network efficiency, all participants in the supply chain must work together to pick up and return

equipment promptly," CP said in a statement.

Bill Mongelluzzo.

(likely no image with original article)

(usually because it's been seen before)

provisions in Section 29 of the Canadian

Copyright Modernization Act.