Washington District of Columbia USA - The CPKC merger will snarl rail traffic in Chicago,

particularly at a key junction where CP operates on trackage rights over CN and Metra, CN has told federal

regulators.

CP says the merger will generate significant growth in intermodal and automotive traffic that will be sorted at its

Bensenville and Schiller Park terminals.

But its "sketchy operating plan" does not fully account for increased traffic east of Bensenville Yard, CN

told the board in a 12 Jul 2022 filing.

"Such under-projections would be a serious problem in light of Applicants' failure to plan any capital

improvements or other mitigating action necessary to address the costs and added congestion of an increase in

trains," wrote Derek Taylor, vice president of transportation for CN's Southern Region.

To get its traffic from Kansas City to Detroit and Eastern Canada, CP must use the Belt Railway of Chicago and the

Indiana Harbor Belt to reach its trackage rights over Norfolk Southern to Detroit and its haulage rights over CSX to

Buffalo, N.Y.

Traffic will increase at Schiller Park by 103 percent, and CP also plans to shuttle an "extensive amount of

traffic" between Bensenville and Schiller Park, Taylor says.

CPKC's planned new train 170 between Lazaro Cardenas, Mexico, and Toronto, for example, will drop blocks for Detroit

and Saint John, New Brunswick, at Bensenville Yard.

Those blocks will then be transferred to Schiller Park to connect with train 142.

The problem, Taylor says, is that this CP traffic will have to run via Tower B12, the junction of Metra, CN, and IHB

routes in Franklin Park, near O'Hare Airport.

"CP traffic between Bensenville Yard and Schiller Park Yard must first move east via CP trackage rights on

Metra's main line to Tower B12 and then north via CP trackage rights over CN's line to Schiller Park Yard," Taylor

explains.

"...however, there is no connecting track in the northwest quadrant at Tower B12 that would allow a direct,

head-in CP movement from Bensenville Yard to Schiller Park Yard. Instead, those CP trains must pull past Tower B12,

stop on the Metra main line, and then perform a reverse shove movement back up CN's line to reach Schiller Park Yard.

Such an operation is cumbersome at best and will increase delays on Metra's and CN's lines if the Applicants increase

the number of trains between Bensenville and Schiller Park Yard."

Taylor expects significant increases in train traffic east of Bensenville and in and out of Schiller Park.

"But Applicants have excluded that segment from their merger analysis, making it impossible to assess the impact

on CN's or Metra's operations in that area of Chicago," Taylor wrote.

But CP, in its filing with the board, says CN's concerns are misplaced.

CP is reconfiguring and expanding Bensenville Yard under an agreement with the Illinois Toll Authority and Union

Pacific.

The expansion and consolidation of intermodal and automotive facilities at Bensenville will reduce the number of CP

trains moving between Bensenville and Schiller Park.

And this means that train counts east of Bensenville may actually be reduced after the merger.

Improvements in the yard include longer arrival and departure tracks that will eliminate the need for long trains to

double or triple out of the yard, which will help reduce congestion in the area, CP says.

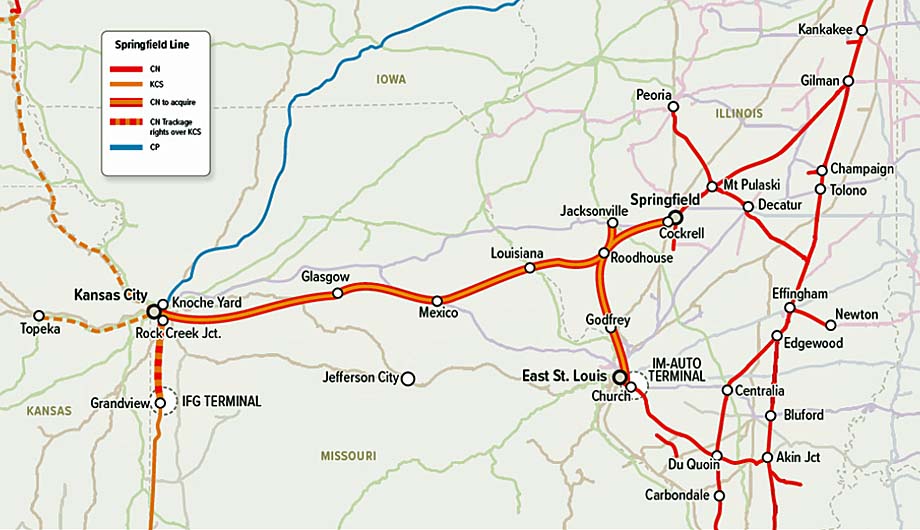

CN used Chicago congestion as a rationale for the STB to order CPKC to divest KCS's former Gateway Western

routes.

The move would allow CN to create the Springfield Speedway, a single-line route linking Kansas City and St.

Louis with Detroit and Eastern Canada via Springfield, Illinois.

CN's route via Matteson, Illinois, and Griffith, Indiana, would largely keep Kansas City traffic out of the Chicago

terminal.

"Divesting the Springfield Line to CN will provide a competitive routing alternative to a merged CPKC that would

avoid additional congestion in Chicago and its suburbs," Taylor wrote.

CN also rebutted comments from a grain shipper in Jacksonville, Illinois, that's served by KCS today.

Bartlett Grain told the STB last month that it opposed a sale of the former Gateway Western routes to CN because it

would end the single-line service it currently enjoys for grain shipments to Mexico.

CN noted that Bartlett had previously backed the ill-fated CN-KCS merger, saying it would "bring new, sustainable,

transportation solutions to our business."

CN says its proposal, which includes granting CPKC haulage rights over the former Gateway Western lines, would provide

seamless operations for Bartlett and other shippers.

The only change, CN says, would be a CN-CPKC crew change at Kansas City, where KCS currently changes crews for grain

trains bound to and from Mexico.

"Ultimately, all existing and future shippers on the Springfield Line would be able to ship any product destined

for the KCS network in virtually the same way they do today," Taylor wrote.

"Not only that, but the shippers would also gain the ability to move their products to additional markets that are

served by CN, and to benefit from price and geographic competition between a merged CPKC and CN."

He also noted that shippers would benefit from CN's proposed US$250 million investments in the routes.

CPKC does not plan to increase capacity on the former Gateway Western.

CN presented the board with letters from four companies who say they support divestiture of the former Gateway Western

lines to CN.

Three of the letters, from PMI Foods, Smithfield Foods, and PSA Halifax, the intermodal terminal operator at the Port

of Halifax, were nearly identical.

Agricultural shipper ADM said the transfer of the lines to CN would create a new competitive option for single-line

service to and from Kansas City.

"This new competitive option will be particularly beneficial to agricultural customers and producers across the

Midwest," Christopher Boerm, president of ADM Transportation, told the board.

Affected ADM processing and grain handling facilities are located in Decatur and Cockrell, Illinois, and Mexico,

Misouri.

The company also does business with multiple customers on the Gateway Western routes.

CP says divestiture of the trackage to CN would be unjustified, unprecedented, and anti-competitive.

"There is no competitive reason for why such a drastic remedy is necessary, especially since divestiture of a line

in the merger context has never been ordered, at least not since the Staggers Act," CP wrote.

Shippers on the former Gateway Western overwhelmingly oppose CN's request to control the lines, CP notes.

Bill Stephens.

(likely no image with original article)

(usually because it's been seen before)

provisions in Section 29 of the Canadian

Copyright Modernization Act.