Washington District of Columbia USA - Canadian Pacific (CP) and Kansas City Southern (KCS)

executives say there's plenty of capacity in Houston to handle the eight additional trains per day they'll run through

the busy terminal within three years after their merger.

But Union Pacific and BNSF Railway told federal regulators, in testimony Thursday and Friday, that they have grave

concerns that the unprecedented rise in through-train traffic would plunge Houston into gridlock, as it did following

UP's 1996 acquisition of Southern Pacific.

The Houston meltdown spread across the UP system and affected the entire rail network.

"The Houston history is well known to this board. And it's with this history, and a healthy respect for the

historical operation implications, that we should view the step-function change in merger-related volume. Failing to

adequately prepare and plan and acknowledge these risks dooms us to repeat history," says John Turner, UP's senior

vice president of the Harriman Dispatch Center and network planning.

BNSF and UP officials criticized CP and KCS for not identifying necessary capacity projects in Houston and the Gulf

Coast, even though the railroads plan to add and extend passing sidings on their lines between Beaumont and the

Midwest.

KCS currently runs 10 to 11 trains per day through Houston.

"I find it a little ironic that, in the detailed operating plan required all over the CPKC joint railroad, that

they needed to add capacity on those lines but yet there's an assertion that there would be no additional capacity

required on the trackage-rights lines," Turner says.

BNSF and UP officials said CP and KCS took a simplistic view of the Houston terminal by contending that overall volume

through Houston would remain below peak levels of 2016 despite eight additional CPKC trains.

One of the flaws in that analysis, Turner says, is that the data used encompasses all of Houston, an unusual

terminal chock-full of yard and local jobs that serve 900 customers.

Much of the traffic remains within Houston as locals shuttle cars from plant to plant and yard to yard.

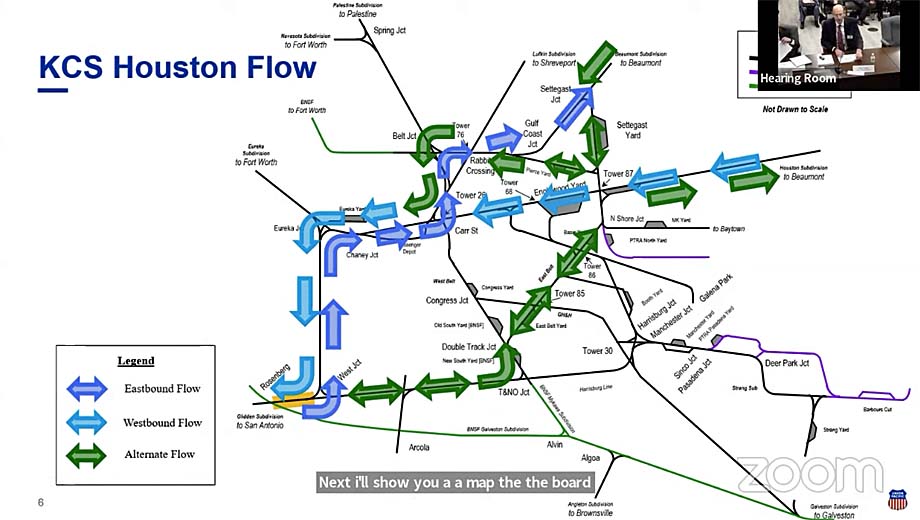

UP and BNSF originate and terminate trains in Houston, but KCS is the only railroad to operate a significant number of

trains all the way through the terminal that contains 15 yards.

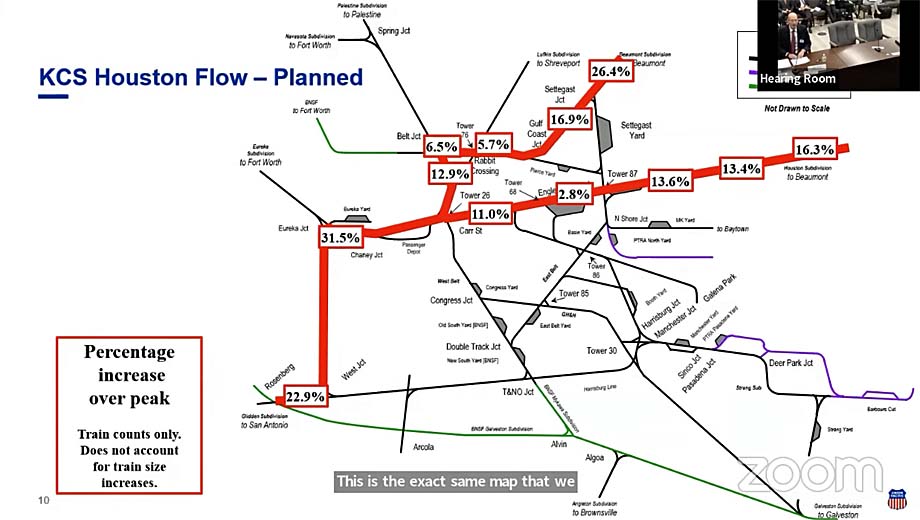

On the trackage-rights routes KCS uses to traverse Houston, the projected volume increases would boost daily train

counts by anywhere from 6 percent to 32 percent above peak levels for eastbound traffic and 3 percent to 32 percent for

westbound trains, Turner says.

That would create congestion on Houston's spiderweb of rail lines and junctions, Turner says.

CPKC trains of up to 10,000 feet would block several key interlockings simultaneously as they thread their way through

Houston, he says.

UP and BNSF also raised concerns about potential bottlenecks elsewhere in Texas, including on UP's Brownsville

Subdivision and around the Neches River bridge in Beaumont.

CP and KCS have not approached UP or BNSF about studying capacity needs, identifying capacity expansion projects, or

funding them, UP and BNSF say.

That's a problem, Turner says, because CPKC envision adding traffic within three years after the merger when it can

take five to seven years to plan and complete capacity projects in Houston.

BNSF and UP asked the STB to condition approval of the merger on CPKC holding off on traffic increases until capacity

projects are identified, funded by CPKC, and completed.

Jon Gabriel, BNSF's vice president of service design and performance, told the STB that it would take as little as

three to six months to complete a traffic study.

STB members questioned how such a condition would be practical, given that CP and KCS wouldn't know the extent of

capacity projects or their cost.

But UP lawyer Michael Rosenthal said that was a problem CP and KCS created by not addressing the issue in their merger

application.

Board member Karen Hedlund said she was worried the capacity study process could drag on for years given the ongoing

dispute between Amtrak and host railroads CSX Transportation and Norfolk Southern on the proposed launch of Gulf Coast

passenger service.

CP and KCS have said they have every incentive to ensure that the Houston terminal remains fluid because their ability

to capture traffic currently handled by UP and BNSF hinges on providing consistent and reliable service.

Laredo Gateway Issues

BNSF and UP also said that CPKC would have every incentive to choke off their interchange traffic at the Laredo

gateway, the busiest border crossing to Mexico, in favor of their own new single-line routes to Chicago and

Canada.

So they asked the board to establish a rate division mechanism that would be an effective way to enforce CP and KCS

promises to keep all gateways open on commercially reasonable terms.

UP and BNSF say KCS made a similar open-gateway promise when it acquired shortline Texas-Mexican Railway, which runs

from Laredo to Robstown, Texas, and is a key part of the KCS international corridor across the Lone Star

state.

BNSF claims that KCS has used its control over pricing of cross-border movements to freeze BNSF out of the market for

carload traffic, citing the precipitous decline of its interchange with KCS for Mexico traffic after it acquired full

control of the Tex-Mex.

BNSF says KCS doubled rates from Robstown to Laredo.

But CP and KCS have said that BNSF shifted its business to the Eagle Pass gateway, where it interchanges with

Ferromex.

"This is not true. BNSF was foreclosed from business at Laredo, and lost business and never recovered it. BNSF

built new business with new customers and destinations from Eagle Pass. Laredo and Eagle Pass serve different markets

and can't substitute for each other," says Paul Hirsch, assistant vice president of BNSF's Mexico business

unit.

Now BNSF fears CPKC would similarly choke off its fast-growing intermodal and automotive traffic that currently moves

under a 2016 agreement with KCS.

Board members raised several questions in separate and extended exchanges with both BNSF and UP

representatives.

Among the issues, BNSF was asking the STB to establish a cross-border rate mechanism that included intermodal

shipments, which are exempt from board review.

BNSF, board member Patrick Fuchs notes, has consistently said intermodal should remain exempt from regulation because

intermodal faces strong competition from trucks and other railroads.

STB Chairman Martin J. Oberman said BNSF's request seemed reactive because the merger proceedings allow the railroad to

request "goodies" that it had not sought despite losing cross-border carload traffic to KCS since

2005.

No rate challenges have been filed regarding cross-border traffic, he noted.

BNSF attorney Peter Denton said he strongly disagreed, noting that mergers change the competitive landscape forever and

that the railroad was simply seeking the ability to compete on a level playing field.

BNSF and UP also noted that several major shipping groups support their proposal for a proportional rate mechanism that

would allow customers to ask for interchange rates covering moves on both sides of the border.

The board has also detailed its schedule for the remainder of the hearings.

Monday's session will run from 13:30 to 18:00 ET, with Tuesday from 09:30 ET to no later than 13:00 to address any

remaining witnesses.

The CPKC closing arguments will begin at 10:30 ET on Thursday.

Bill Stephens.

(likely no image with original article)

(usually because it's been seen before)

provisions in Section 29 of the Canadian

Copyright Modernization Act.