New York New York USA

North America - Nearshoring, in which manufacturing is relocating from Asia, mostly China, to North

America, mostly Mexico, is one of the key drivers behind creation of CPKC, the first and only transnational,

single-line railroad linking Canada, the United States, and Mexico.

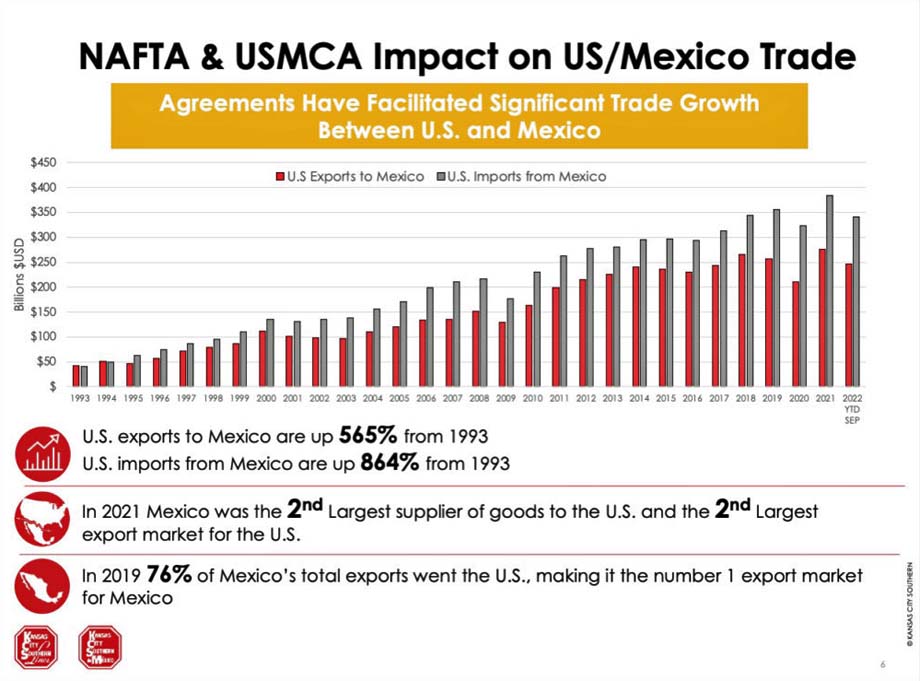

CPKC, the merger of the Canadian Pacific and Kansas City Southern, was originally announced on 21 Mar 2021, roughly one

year after USMCA (United States-Mexico-Canada Agreement) was ratified, replacing NAFTA (North American Free Trade

Agreement), which had been in place since the mid-1990s and helped drive privatization of Mexico's national railroad

system.

Some background: On 19 Jun 2019 the U.S. Senate passed the Protocol to replace NAFTA with USMCA, described by former

U.S. Trade Representative Robert Lighthizer as "the gold standard by which all future agreements will be judged,

and citizens of all three countries will benefit for years to come."

The U.S. House of Representatives passed the agreement on 19 Dec 2019, the Senate passed it on

16 Jan 2020.

The Canadian House of Commons and Senate passed the USMCA Implementation Act on 13 Mar 2020.

Three years later, 14 Mar 2023, one day before the Surface Transportation Board approved the CPKC merger, KCS President

and CEO Pat Ottensmeyer gave a presentation, "Nearshoring in Mexico: A Lifetime Opportunity," at Railway

Age's Next-Generation Freight Rail Conference in Chicago.

As Railway Age's 2020 Railroader of the Year and 2022 Co-Railroader of the Year with CP President and CEO Keith Creel,

he has talked extensively about nearshoring, and his role as chair of the U.S. Chamber of Commerce U.S.-Mexico Economic

Council, in which he worked to ensure that the rail industry has a voice by working with public and private-sector

leaders to strengthen bilateral commercial ties.

Ottensmeyer retired as KCS chief executive on 14 Apr 2023 when CPKC's Final Spike ceremony took place, and is now a

special advisor on Mexican affairs to CPKC chief executive Creel.

"The thesis for investing in Mexico remains strong," Ottensmeyer said as he began his NGTC

talk.

"Mexico has maintained Investment Grade ratings throughout the pandemic. With exception of early in the pandemic,

the Peso exchange rate has remained stable for the past five years. Through August 2022, Mexico's manufacturing sector

has grown at three times the rate of GDP growth. The country's manufacturing base is large and is well integrated into

existing North American supply chains. Most trade disputes have been resolved in Mexico's judicial system, and the

Mexican Supreme Court has ruled in favor of investors in proposed changes in Electricity Law."

Ottensmeyer referred to the ongoing U.S.-China trade war, in which the U.S. imposed trade tariffs on China in the first

half of 2018.

Since then China has lost more than four percentage points of its share of U.S. imports.

Reshoring/Nearshoring Push Factors

The pandemic and the Russia-Ukraine conflict are the two main "push factors" behind nearshoring and

"reshoring," the practice of bringing manufacturing and services back to the U.S. from overseas.

"The pandemic caused significant and widespread disruptions to global supply chains," Ottensmeyer

noted.

"Companies exposed to global trade are trying to mitigate the risks from supply chain disruptions by moving

supply chains closer to home. Time zones are also more relevant than before as video-conferencing for meetings,

management, etc., are more widely utilized."

On the Russia-Ukraine conflict, security is a major concern.

"Sanctions on Russia by the West make companies want to relocate resources to countries that have lower risk of

sanctions, friend-shoring," Ottensmeyer said.

"An energy crisis is impacting many countries, but Europe especially. Firms are looking for locations with more

energy availability and reliability, and North America has plenty of energy, including Mexico's resource potential for

renewable energy."

Reshoring/Nearshoring Pull Factors

There are also "pull factors" for nearshoring/reshoring.

"The goal of the USMCA is to reduce tariff costs and boost the integration of regional supply chains among its

members," said Ottensmeyer.

"Since the original NAFTA, merchandise trade in North America has increased steadily. The three countries in the

region not only trade, but also co-produce. Mexico is not only one of the top three exporters to the U.S., but also

one of the top three importers. Many intermediate goods go back and forth several times across the border. Mexico

already has a large manufacturing base that is highly integrated with the U.S. Its macrostability means the real

exchange rate has remained stable in recent years. The country has political stability when compared to other emerging

markets. Institutional checks and balances have been working. One recent example is that Congress rejected a

constitutional change proposed by the President on energy, as the bill was perceived as discouraging private investment

in the sector. Mexico has more than 25 years as a manufacturing powerhouse and has developed human capital at the

production and managerial levels. For example, it's usually among the top ten countries in the number of engineering

graduates per year. Wages have remained stable, but wages in China have increased substantiallyM Despite recent

increases in minimum wages, Mexico continues to have one of the lowest minimum wages compared to other EM or Latin

America countries, US$4.80 per hour compared with US$6.50 per hour in China."

The Path Forward

To leverage this "opportunity of a lifetime," close dialogue must be elevated "at every possible

level," Ottensmeyer noted.

This includes the North American Leaders' Summit and North American Competitiveness Committee, high-level economic

dialogue among the three countries, and encouraging private-sector engagement.

"We need to improve cross-border mobility of goods and people, establish tri-national protocols to reduce supply

chain disruptions during any future crisis, strengthen the regional digital economy via expansion of connectivity and

optimization of cybersecurity, and promote sustainable economic and social development in the lesser prosperous regions

through workforce development and financial inclusion," he said.

"We've always been taught that the three most important factors in success were location, location,

location," Ottensmeyer stressed.

"The same can be said for where to establish a business. In a post-pandemic environment, now is a great time to

review what nearshoring could mean for a company's supply chain. The benefits of USMCA complemented by the impacts of

the COVID-19 global pandemic and international trade tensions have created the perfect opportunity for companies to

explore the benefits of shifting manufacturing to Mexico to take advantage of the many benefits nearshoring has to

offer. For companies that understand the concept of the cost of doing business and the importance of a comprehensive

cost benefit analysis and want to offer quality products and services produced in the most economical manner possible,

Mexico offers several cost benefits that make it an attractive manufacturing and distribution hub, such as a stable

corporate tax rate and an incentive program combined with low labor rates and low costs of inbound freight, especially

when compared with China. Mexico's composite tariffs with the U.S. of 0.04 percent) compare very favorably with China's

composite tariff rate of 19.2 percent. Mexico's current tax rate of 30 percent has not changed since 2010, and the

amount a company pays in overall taxes might be even lower if it takes advantage of Mexico's Maquiladora Program or

the country's Special Economic Zones. In addition Mexico has 14 free trade agreements with more than 50 countries

representing more than 60 percent of world GDP."

"U.S. proximity to Mexico is a major advantage to businesses due to quicker transit times. Transporting goods from

Mexico to New York can take about 6-12 days while going from Shanghai to New York can take about 35 days. Mexico to

Los Angeles is 4 days, where Shanghai to Los Angeles is 22-26 days. Additionally, components can be sourced from the

U.S., assembled in Mexico, and shipped back to the U.S. in a short amount of time. With Mexico located in the same time

zones as the U.S. (Pacific, Mountain and Central), companies will benefit from greater efficiency and productivity. As

more Americans speak Spanish and more Mexicans are speaking English, the language communication barrier is less of an

issue in today's marketplace."

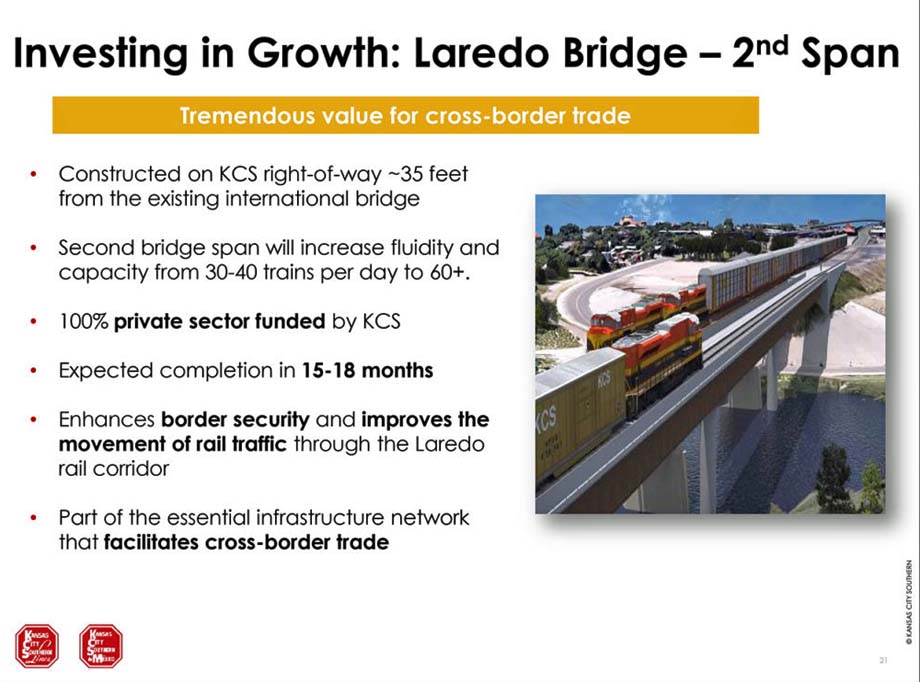

"Mexico's transportation and communications infrastructure have been upgraded, promoting the flow of freight over

the border, reducing bottlenecks and improving logistics for U.S.-Mexico cross-border trade. Mexico has 16 major

maritime hubs offering Pacific Ocean and Atlantic Ocean access. Critical investments include CPKC's (KCSM) Veracruz

rail corridor connection to Oaxaca connecting the Atlantic and Pacific coasts, and an expansion of the Lazaro Cardenas

Specialized Automotive Terminal. Finally because of Mexico's geographic proximity and figurative closeness with the

U.S., corporate social responsibility practices and trends are on the rise in Mexico."

BOA on Nearshoring

According to a recent Bank of America (BOA) analysis, Mexico "can increase exports by 9 percent of GDP.

Nearshoring represents Mexico's best growth opportunity for the next 10 years and it is already occurring. The country

is a natural candidate for firms to relocate production to serve the U.S. market, following the fragmentation of

global supply chains and the ongoing reversal of the China trade shock of the early 2000s. U.S. imports are close to

US$3 trillion (220 percent of Mexico's GDP). Mexico's share of imports is 14 percent, while China's share recently fell

by 4 percent to 18 percent."

BOA believes the positives should offset the negatives. "Nearshoring has started and led to a Mexican

manufacturing boom. The sector has grown more than 5 percent year-to-date in real terms—one of the few sectors that is

already above pre-pandemic levels (+6 percent) and that is growing as a percentage of GDP. Manufacturing exports are up

17 percent in year-to-date dollars, and Mexico increased its share in U.S. imports in some manufacturing products by

50 percent in the past three years. According to a recent survey by Mexico's central bank, 16 percent of large firms in

Mexico already report benefits from nearshoring. Reshoring is positive for Mexico as it would entail a positive

productivity shock for the country at the expense of China."

William C. Vantuono.

(likely no image with original article)

(usually because it's been seen before)

provisions in Section 29 of the

Canadian Copyright Modernization Act.