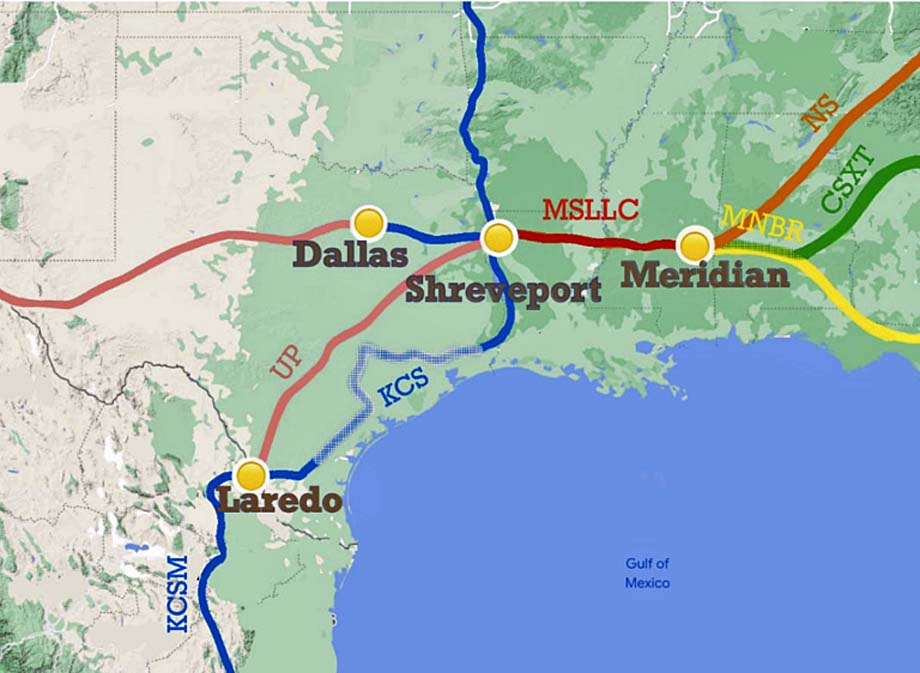

America - The agreement CPKC and CSX Transportation reached last month to create a new corridor

linking the Southeast with Texas and Mexico via Meridian, Mississippi, is not a new idea.

More than two decades ago KCS CEO Mike Haverty sought to tie his cross-border railroad to CSX by having the companies

purchase short line Meridian & Bigbee (M&B).

Today it's still a good idea, and it's easy to see why.

Genesee & Wyoming's (G&W) Meridian & Bigbee plugs a 148 mile gap between CPKC at Meridian and CSX just

outside of its Montgomery, Alabama, hub.

The route is a big advantage over the current CPKC-CSX interchange via the circuitous, slow, and notoriously

unpredictable New Orleans gateway.

And direct interchange is superior to the existing haulage agreement between CSX and M&B.

The deal will provide CSX with far better access to Houston; Laredo, Texas, and Mexico, while the new gateway gives

CPKC another avenue for volume growth, something it needs in order to pay for the $31 billion CPKC

merger.

The three-way agreement involving CPKC, CSX, and G&W has a lot of moving pieces.

CPKC will acquire the trackage M&B owns between Meridian and Myrtlewood, Alabama.

CSX will operate the trackage it currently leases to M&B between Myrtlewood and Burkeville, Alabama, 20 miles west

of Montgomery.

The direct interchange technically will be at Myrtlewood.

M&B, meanwhile, will continue to provide local service between Myrtlewood and Meridian without interchange

restrictions.

The big picture, CPKC CEO Keith Creel says, is the potential created by direct interchange with CSX via Meridian

because the route connects the high-growth areas of the Southeast, Texas, and Mexico.

By 2026 four new auto plants will join those CSX already serves in the Southeast and Midsouth, which Creel says will

create an opportunity for the railroads to participate in automotive supply chains linking parts and assembly plants

in the U.S. and in Mexico, where CPKC de Mexico serves 16 assembly plants.

Intermodal customer Schneider partners with CPKC for its cross-border Mexico traffic and partners with CSX in the East,

so the expectation is auto parts would move in intermodal service over the new interchange route.

Creel says CPKC and CSX will beef up the M&B's track to Federal Railroad Administration Class III standards, which

will allow 40 mph operation, up from the current combination of 10 mph and 25 mph track speeds.

As part of its maintenance responsibilities in Meridian, CPKC has begun making improvements to the M&B connection,

including clearance work that will allow the route to handle double-stacks.

In a decade, Creel says it's possible that due to traffic growth the line could have centralized traffic control

and be good for 60 mph operation.

That suggests CPKC and CSX would exchange at least three trains each way per day, which operations experts say is

typically the volume trigger for investing in CTC.

The CPKC-CSX direct interchange via Meridian comes with some competitive wrinkles.

First, the deal does not make Norfolk Southern happy.

The Meridian-Shreveport, Louisiana, route is part of the NS-KCS Meridian Speedway joint venture that dates to

2006.

NS gained a 30 percent interest in the KCS line in exchange for investing US$300 million in capital

improvements.

Under the joint venture, NS has the exclusive right to interchange certain types of intermodal traffic with KCS, and

now CPKC, at Meridian.

The exclusivity agreement covers NS intermodal traffic moving between the Southeast and Dallas, as well as

transcontinental intermodal traffic between the Southeast and West Coast via Shreveport or Dallas/Fort

Worth.

CSX unsuccessfully sought to blow up the exclusivity arrangement during regulatory review of the CPKC

merger.

But thanks to the new agreement with CPKC, CSX will be able to route intermodal traffic between the Southeast and CPKC

terminals in Kendleton, Texas, outside Houston, Laredo, Texas, and in Mexico.

The service will be new competition for NS.

Second, CSX currently hands its Mexico-bound traffic to Union Pacific at New Orleans.

UP then hauls it to CPKC de Mexico at the Laredo gateway.

Count on CSX cutting out the UP middleman and diverting this traffic to the faster and presumably far more predictable

CPKC route via Meridian.

Finally, during the CPKC merger hearings all of the other Class I railroads raised concerns that CPKC would crimp their

existing KCS and CP interchanges as part of an effort to unfairly divert traffic to the new combined CPKC

network.

Ironically, here's CPKC creating a new gateway with CSX.

Creel says CPKC is interested in growing with both Norfolk Southern and CSX via the Meridian Speedway.

And a CPKC spokesman says the railway will honor its agreement to continue handling NS intermodal traffic over the

Speedway.

"This is a BIG deal," Haverty says of the three-railroad agreement.

"This is exactly what I proposed to CSX CEO John Snow well over 20 years ago. I told him we could both buy this

line and it would give CSX access to the Meridian line, the shortest, fastest, and safest rail route between the

Southeast and Southwest U.S."

The railroads held meetings but nothing came of them.

"Why didn't such a logical concept become reality back then? Because the two dominant railroads in the East were

afraid to do anything with KCS that would clearly upset the two dominant railroads in the West," Haverty

says.

"The big boys in the West both wanted KCS to disappear and did not want the big boys in the East doing business

with us."

The history of the KCS Meridian route bears this out.

The first issue to cause friction was the NS-BNSF interline intermodal service between Atlanta and Alliance, Texas,

just outside Fort Worth.

NS, concerned that its Southwest and West Coast intermodal traffic might stub at Meridian, in 2000 entered a haulage

agreement with KCS to move this intermodal traffic from Meridian to Alliance.

This agreement really ticked off Union Pacific, Haverty says.

But BNSF wasn't happy, either, he says, because the haulage deal shortened its length of haul and therefore its revenue

on Southeast intermodal traffic.

The 2006 NS-KCS Meridian Speedway agreement prompted BNSF to divert its Atlanta intermodal business to CSX via the

circuitous route through Springfield, Missouri, and Memphis, with interchange at Birmingham, Alabama.

As a result, NS and UP then teamed up for transcontinental interline intermodal service over the Speedway via

Shreveport.

Today's CPKC-CSX deal is good for both railroads, as well as the railroad industry, because it will produce volume

growth, says Haverty, who is pleased to see things finally come full circle under Creel.

"Keith Creel is a phenomenal railroad leader," Haverty says.

"Keith has accomplished many things in a short period of time that I couldn't get done during my 20 year career at

KCS. He is the most innovative and operating-oriented CEO in the U.S. rail industry, in my opinion."

Bill Stephens.

(likely no image with original article)

(usually because it's been seen before)

provisions in Section 29 of the Canadian

Copyright Modernization Act.