(Link fails continuously)

Vancouver British Columbia - Rail volumes have largely returned to normal at the Canadian West

Coast ports of Vancouver and Prince Rupert following the summer labor strikes, although train volume overall has yet to

catch up, according to data collected and analyzed by rail network visibility provider RailState.

"We're constantly monitoring volume movements across the rail network in Canada and it appears that rail traffic

is returning to a status quo," John Schmitter, RailState co-founder and chief commercial officer, said in a Friday

news release.

"We haven't seen a big increase in volume, and an expectation that the railroads have unused capacity sitting

around that can quickly be brought on line to clear what's built up isn't reasonable. The decreased volume seen in July

will take a long time to resolve, or it is lost for good."

Workers with the International Longshore and Warehouse Union had gone on strike on 1 Jul 2023 at the Canadian West

Coast ports over a new contract.

The 13 day strike ended after a tentative agreement was reached.

But then the agreement was rejected by union members, putting port operations in limbo.

The union and its employers reached another agreement on 30 Jul 2023 according to news reports.

That agreement was subsequently ratified.

RailState looked at data starting from when the main strike ended.

While the strike might be over, its effect will likely be felt on the railways for weeks, industry observers have

noted.

Both CPKC and CN have been working to clear the backlogs at the ports.

During its second-quarter 2023 earnings call, CPKC leaders estimated that the strike at the Canadian West Coast ports

cost the railway $80 million in revenue.

On CN's second-quarter 2023 earnings call, executives estimated it could take about eight weeks for the overall supply

chain to recover.

CN's international intermodal traffic two weeks after the strike ended was above its historical average.

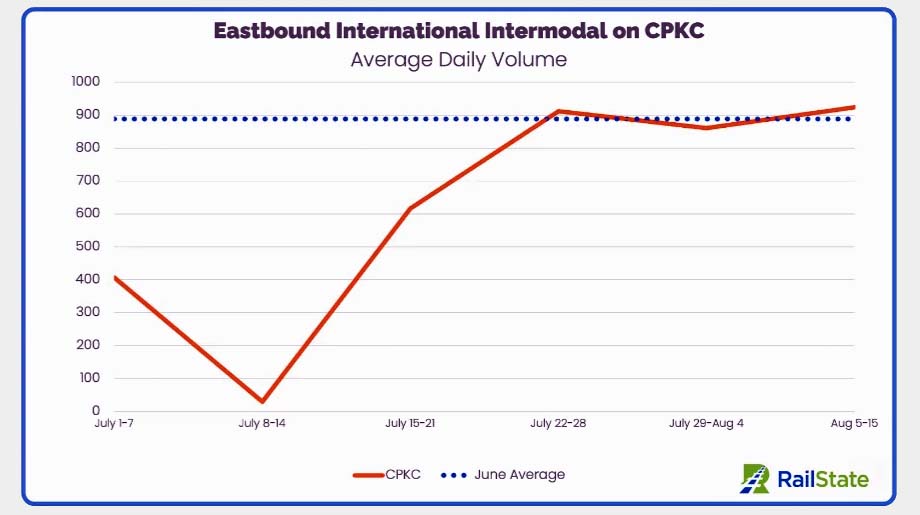

CPKC's average daily volume for international intermodal for the first two weeks of August is hovering roughly around June levels, according to RailState's data.

Meanwhile, coal traffic grew for CN during the strike because some producers opted to divert trains to the Port of

Prince Rupert instead of using the Port of Vancouver, where Neptune had shut down during the strike.

Still, coal export carloads at CN through the first half of August were down 22.4 percent from July, and down 12.3

percent from June, according to RailState.

Grain export carloads also dropped following the strike, but they could pick up again in the fall as grain producers

head into peak harvest time.

Joanna Marsh.

(likely no image with original article)

(usually because it's been seen before)

provisions in Section 29 of the

Canadian Copyright Modernization Act.